Answer:

Step-by-step explanation:

![\left[\begin{array}{ccc}Year&Cashflow&Present Value\\0&-180,000&-180,000\\1&30,000&26,086.9565\\2&29,100&22,003.7807\\3&28,227&18559.7107\\4&27,380.19&15,654.7125\\5&26,558.7843&13,204.4097\\Net&Value&-84,490.4299\\\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/r7odk8wqvoszzqi9bmlf1625h3xywjc681.png)

The first step will be calculate the alue of eachcash saving

mulitply by (1- 0.03) which is the rate at which the flow decrease.

Then we calculate the present value of each cashflow

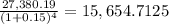

For example year 4:

Then we add all the cash saving and compare with the machien cost to calcuale the net present value of the machine