Answer: So B/C ratio = PW(B)/PW(C) =

= 1

= 1

So economically there is no befit and no loss of new fire station.

Step-by-step explanation:

Net annual benefit B = Benefit-Disbenefit = 550000-90000 = 460000

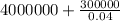

I = 4000000

O&M(Annual keep up cost) = 300000

i = 0.04

As n is not given so assuming this project to be perceptual.

P.V of perpetuity =

Now;

PW(B)=tex]\frac{460000}{0.04}[/tex] = $11500000

PW (C) = I +PW

(O&M) =

(O&M) =

= $11500000

= $11500000

So B/C ratio =

=

=

= 1

= 1

So economically there is no befit and no loss of new fire station.