Answer:

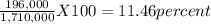

a) Firm’s return on assets = 11.46 %

b) Return on stockholders’ equity = 19.37%

c) Profit margin = 3.27%

Step-by-step explanation:

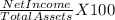

a) Return on assets =

=

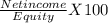

b) Return on stockholder's equity =

Equity =Total assets - Debt = $1,710,000 - $698,000 = $1,012,000

Return on equity =

c) Asset Turnover ratio =

= 3.5

= 3.5

then Net sales = 3.5 X Total Assets = = 3.5 X $1,710,000 = $5,985,000

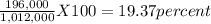

Profit margin =

![(Net profit)/(Net sales) X 100 [tex]= (196,000)/(5,985,000) X 100 = 3.27 percent](https://img.qammunity.org/2020/formulas/business/college/385y85xmm99pl69bes73upra1dlqf62dk7.png)

a) Firm’s return on assets = 11.46 %

b) Return on stockholders’ equity = 19.37%

c) Profit margin = 3.27%