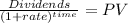

Answer:

i will pay $80.47 or lower, to achieve 14% yield or higher.

Step-by-step explanation:

We have to calcualte the present value of the dividends cash flow.

because the dividends will growth until a certain date, we cannot use the gordon model.

![\left[\begin{array}{ccc}Month&Dividend&PV&Year1&13&11.40&Year2&19&14.62&Year3&25&16.874&Year4&31&18.35&Year5&37&19.21&Year6&43&19.591&Intrinsic&Value&80.47\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/eqk1i1sq2cjg2r0glaalei6soas5br7cdk.png)

For each dividend, we do previous year + 6

Then for Present value:

for example year 3