Answer:

Cost of Goods Sold = $1,700,000

Gross Proft = $1,740,000

Step-by-step explanation:

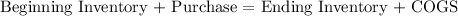

We solve this assingemtn using the inventory identity:

We post the given and solve for the missing part:

640,000 + 2,020,000 = 960,000 + COGS

COGS = 640,000 + 2,020,000 - 960,000 = 1,700,000

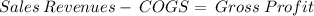

Next we use the COGS value to calculate the gross profit.

3,440,000 - 1,700,000 = 1,740,000