Answer:

We can accept the note giving 418,742.13 or less.

Step-by-step explanation:

There is a note due in 5 year.

When someone offered this note, it was 3 years from maturity. Is asking you to purchase the note for cash.

The idea is that we receive 500,000 in the future.

For how much are we willing to accept the note?

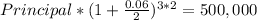

We are going to discount the 500,000 in three years using our 6% rate compound semiannually.

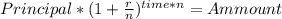

Where n is the times the rate compounds within a year.

semiannual rate, capitalize 2 times per year.

We post our givens and solve:

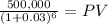

PV = 418742.1283

PV = 418,742.13

We can accept the note giving 418,742.13 or less.