Answer:

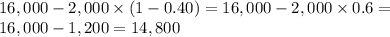

Conversion Cost Equivalent Units = 14,800

Step-by-step explanation:

Beginning WIP = 0

Started 16,000

Ending 2,000 at 40%

Equivalent cost for conversion

There was none beginning inventory and the direct materials information is not relevant to calculate the conversion cost.