Answer:

We are going to pay $892.137 or less for the bonds.

Step-by-step explanation:

We need to calculate the present value of the bond at 11% interet rate

Cashflow from the bond:

Principal x interest = interest service

1,000 x 9.5% = 95

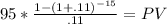

Present value of annuity of 95 during 15 year at 11%

Present value of the interest service 683,1326097

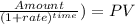

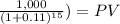

Second we have to calculate the present value of the 1,000 principal in 15 years

209.0043467

Finally we add both together for the present value fothe bond at our rate

209.0043467+ 683,1326097 = 892.1369564 = 892.137