Answer:

In 3.5 years she will pay the wardrobe

Step-by-step explanation:

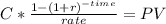

We are going to calculate the time for an annuity of 270 with monthly compound interest to achieve 8368 present value

We post the know values

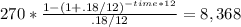

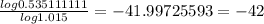

First: we clear the dividend

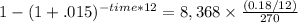

Then we set up the formula to use logarithmic

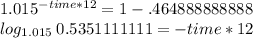

We use logarithmic properties to solve for time

-42 = time * -12

-42/-12 = 3.5 = time

It will take 42 months or 3.5 years