Answer:

YTM = 3.094%

Step-by-step explanation:

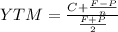

If you can't calculate the YTM using excel or a financial calcualtor, you can do it by hand using the approximation formula:

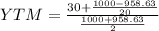

C = interest payment = 1,000 x 6%/2 = 30

F = face value = 1,000

P = 985,63

n = payment periods = 10 years x 2 payment per year

YTM = 3.094%

Notice, this YTM is an approximation