Answer:

Depreciation expense = 2,900

Step-by-step explanation:

Our goal would be to construct the formula where depreciation expense is and then increase deepth until find something we can work:

Expanding expenses we find depreciation expense

Here we don't Know Income Before taxes so we have to work that first

Here we don't Know Net Income taxes so we have to work that first

Here we got the other component of the formula, so it is possible to solve for net income and from there achieve the answer

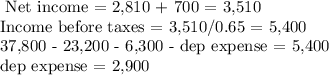

Net income = 2,810 + 700 = 3,510

Income before taxes = 3,510/0.65 = 5,400

37,800 - 23,200 - 6,300 - dep expense = 5,400

dep expense = 2,900