Answer:

A. A higher percentage of the high operating leverage firm's costs are fixed.

Step-by-step explanation:

Let's first focus on what is operating leverage:

It represents the degree on which an increase in sales revenue, will also increase the operating income of the company

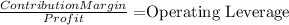

So Being Contribution Margin the amount generate for sales, dividing that for the profit, we got the relationship between sales and income.

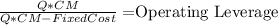

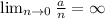

We can expand those like this

Where Q is the uantity of units sold

and CM is the contribution margin per unit.

Resuming: relationship between sales and operating income

That definition cuts "C" and "D" because they talk about debt, this measurement doesn't involve debt.

Now let's check "A"

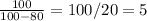

It state that higher fixed cost amkes the leverage go higher, let's see if that is true:

Fixed Cost is subtracting in the divisor, so higher fixed cost makes the divisor lower.

When this happens, the result of the division is higher.

So this example is true

As an example:

If you have 100 CM and 80 Fixed cost then

IF you have 100 CM and 50 Fixed cost then