Answer:

(A)

cash 700,353

discount 49,647

bonds payable 750,000

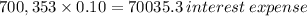

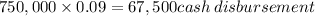

(B)

interest expense 70035.3

cash 67,500

discount on bonds 2535.3

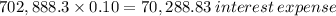

(C)

interest expense 70,288.83

cash 67,500

discount on bonds 2,788.83

Step-by-step explanation:

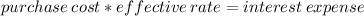

(A) face value - issued amount = discount

(B)

Amoritization On discounts will be the diference 2535.3

(C) same procedure as (B) but now the bond value increase.

It is 700,353 + 2535.3 = 702,888.3

Amoritization On discounts will be the diference 2,788.83