Answer:

The current Price of the bond will be 1,006.20

Step-by-step explanation:

We have to calculate the present value of the bonds cash flows at a 8.5% rate

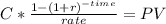

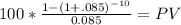

Present value ofthe interest service:

PV = $563.9183

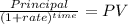

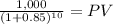

Present Value of the principal

PV = $422.2854

Now we sum both concepts

422.2854 + 563.9183 = 1006.2037 = 1,006.20