Answer:

C = $14,429.57 You can withdraw up to this amount.

Step-by-step explanation:

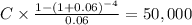

we have to calculate the cuota of the annuity for present value

Where:

rate = 0.06

time = 4 years

PV 50,000 your uncle gift you.

C = $14,429.57

Making 4 withdrawals for this amount, you will earn an annual return of 6%