Answer:

COGS overstated for 5,000

Step-by-step explanation:

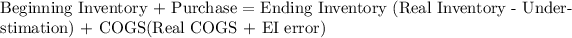

The COGS will be overstated for the same ammount, that is because of the inventory identity.

If ending Inventory has a problem, it will be transferred to COGS as well to equalize the formula

If ending Inventory is understated it means their alue is less than it's real value,

so to balance the formula COGS need to be overstated.