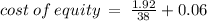

Answer: 11.05 %

Explanation: Required return can be defined as the measure of profitability of business in relation to its different types of securities such as equity, preference and debt.

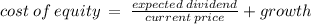

In this problem we can compute return on equity by using following formula :-

11.05%