Answer: 12.51%

Explanation: Probability of normal = 100 - (35+10)=55%

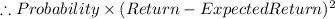

Expected return = Respective return*Respective Probability

= (22*0.1)+(9*0.55)+(-14*0.35) = 2.25%

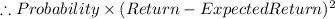

When

(a) Return = 22% , Probability = 0.1

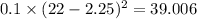

(b) Return = 9%, Probability = 0.55

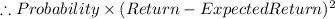

(b) Return = -14%, Probability = 0.35

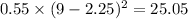

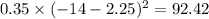

Total=156.48%

![Standard deviation= [Total Probability * (Return-Expected Return)^(2)/ Total probability]^(1/2)](https://img.qammunity.org/2020/formulas/business/college/vybq2xg49qgzmbcv0zzdu6vk1hzcizrev2.png)

Standard deviation = 12.51%