Answer : 4.34 %

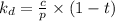

Explanation: The effective interest rate a company pays on its debt obligation is called cost of debt. The cost of debt is denoted by [k]x_{d}[/tex] . As there is a tax shield available on debt interest it is generally calculated by subtracting the marginal tax rate from before tax cost of debt .

.

where,

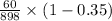

c= coupon payment = 1000 * 6% = 60

p = current market price = $898

t= marginal tax rate

therefore :-

=

= 4.34 %