Answer:

Present Value of Investment Opportunity = $95,096

Step-by-step explanation:

Net cash inflow = Cash inflow - cash outflow

Given that net cash inflow = $30,000 per month for 4 years

Rate of return = 10%

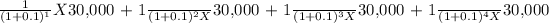

Present Value =

= $27,272.72 +$24,793.38 + $22,539.44 + $20,490.40

= $95,096 (rounded off to nearest dollar)

Present Value of Investment Opportunity = $95,096