Answer:

To Calculate the monetary value of both jobs, you would have to calculate the percent tax rate of each salary and add the nontaxable benefit after taxes.

Explanation:

Reminder: since the 25% is a tax rate which we need to subtract from the salary, 75% would be what is left over from the salary after taxes.

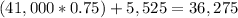

Job 1: Job 1 pays a salary of $41,000 and $5,525 of nontaxable benefits. So we calculate the 75% that is left after taxes and add the benefits afterwards.

So the monetary value of Job 1 would be $36,275

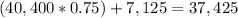

Job 2: Job 2 pays a salary of $40,400 and $7,125 of nontaxable benefits. So we calculate the 75% that is left after taxes and add the benefits afterwards.

So the monetary value of Job 2 would be $37,425