Answer:

- 1200 BEPunits

- $14,400 BEP dollars

- second scenario

Step-by-step explanation:

contribution margin = Sales - Variable Cost

12 - 10 = 2 contribution margin

fixed expenses = 2,400

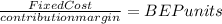

BEP = 2,400/2 = 1,200 units

Resuming: each unit contributes with $2 dollars therefore it needs to sale 1,200 untis to pay the fixed cost.

units x sales price = sales revenue

1,200 x 12 = 14,400 BEP in Dollars

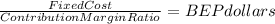

Also it is posible to get this by using contribution margin ratio

in the BEP formula:

contribution margin/sales price = 2/12 = 1/6

fixed cost /contribution margin ratio = 2,400/(1/6) = 14,400

Scenario were fixed cost increase:

increase in fixed/contribution margin + previous BEP = BEPunits

increase in fixed/contribution margin ratio + previous BEP = BEPdollars

600 fixed cost /contribution margin = 600/2 = 300 more units to our prevous 1,200 total of 1,500

600 fixed cost /contribution margin ratio = 600/(1/6) = $3,600 more sales revenue to our prevous 14,400 total of 18,000