Answer:

A profit Maring of 17.16% would be needed to achieve the target ROE of 20% if everything else holds constant

Step-by-step explanation:

Return on Equity is the percent of net income achieve per dollar of equity

It is used to check the management of capital investment. (We give you this much, you generate that)

Where Average Equity:

In this case we have no information about beginning or ending so we go with the vlue provided for Equity: $875,000

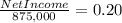

Now we can see how much the net income needs to be to achieve 20% ROE

Net Income = 175,000

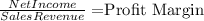

Now, which is the profit margin that generates this net income:

This represents the percentage of sales which turned into profits. It can be interpreted as:

cents of net income per dollar of sale.

Having our target net income, and holding the sales constant we need a profit margin of:

A profit Maring of 17.16% would be needed to achieve the target ROE of 20%