Answer:

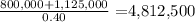

$4,812,500 Dollar sales to achieve EBT of 1,125,000

Step-by-step explanation:

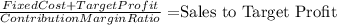

The goal would be to calcualte the break even formula adding in the dividend the target profit:

Where:

Where:

So first step

$450 Sales - $270 Variable Cost = $180 Contribution Margin

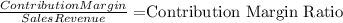

Second:

180/450 = 40% CM ratio

Finally: