Answer:

16.16%

Step-by-step explanation:

Given that:

A credit card issuer states that it charges a 15.00% nominal annual rate = 0.15

And which you must make weekly payments i.e weekly compounding, Therefore, there are 52 periods in a year.

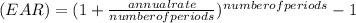

The Effective annual rate (EAR) can be calculated by the formula;

=

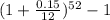

∴ we have;

= (1 + 0.002885)⁵² - 1

= (1.002885)⁵² - 1

= 1.16160656 - 1

= 0.16160656

= 16.160656 %

≅ 16.16 %

∴ The effective annual rate (EAR) = 16.16%