Answer:

$17,277.07

Explanation:

Present value of annuity is the present worth of cash flow that is to be received in the future, if future value is known, rate of interest is r and time is n then PV of annuity is

PV of annuity =

![(P[1-(1+r)^(-n)])/(r)](https://img.qammunity.org/2020/formulas/mathematics/college/n425g7cl6obyqoazs2rkq3ksfxsd4mm2rh.png)

=

![(3000[1-(1+0.10)^(-9)])/(0.10)](https://img.qammunity.org/2020/formulas/mathematics/college/dkpxmwk1lwipxezv8v9wgfsxeyea821vkl.png)

=

![(3000[1-(1.10)^(-9)])/(0.10)](https://img.qammunity.org/2020/formulas/mathematics/college/42l69i14cvcg8lx1nfupen8tn14bwnk2xf.png)

=

![(3000[1-0.4240976184])/(0.10)](https://img.qammunity.org/2020/formulas/mathematics/college/b9qclalmy95hs6bwg9vzswz09esjnxxas3.png)

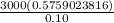

=

=

= 17,277.071448 ≈ $17,277.07