Answer:

The price of the home = 232,000

20% is down payment.

Part A:

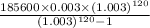

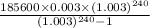

So, the loan amount will be =

Loan amount or p = $185,600

Part B:

p = 185600

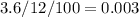

r =

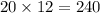

n =

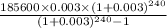

The EMI formula is :

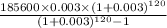

Now putting the values in formula we get

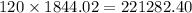

=>

Monthly payments = $1844.02

Part C:

p = 185600

r =

n =

Now putting the values in formula we get

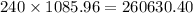

=>

Monthly payments = $1085.96

Part D:

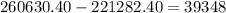

For 10 year loan you have to pay =

For 20 years loan you have to pay =

So, you ended up paying

dollars more in longer loan.

dollars more in longer loan.

The difference is $39,348.