Answer:

$1314.37

Explanation:

We have to calculate final value i.e. balance to earn $100,000 annually from interest.

=

= $1,250,000

= $1,250,000

Now, N = n × y = 12 × 25 = 300

I = 8% = APR = 0.08

PV = 0 = PMT = 0

FV = 1,250,000 = A

![A=(PMT* [(1+(apr)/(n))^(ny)-1])/((apr)/(n))](https://img.qammunity.org/2020/formulas/mathematics/college/n2xpra4w3frpt67jhat0yj1i8h1ub2o09y.png)

![PMT=(A* ((APR)/(n)))/([(1+(APR)/(n))^(ny)-1])](https://img.qammunity.org/2020/formulas/mathematics/college/oigerpqjvwpm8ggzsx144b2olxyx1jt1qa.png)

![PMT=(1,250,000* ((0.08)/(12)))/([(1+(0.08)/(12))^(12* 25)-1])](https://img.qammunity.org/2020/formulas/mathematics/college/d7elt47xr9nibaczmc5p844bl1qifn9g9k.png)

![PMT=(1,250,000* (0.006667))/([(1+(0.08)/(12))^(12* 25)-1])](https://img.qammunity.org/2020/formulas/mathematics/college/n4w128xuj7eghpauv1d5h4jgr7aegppayv.png)

![PMT=(1,250,000* (0.006667))/([(1+0.006667)^(300)-1])](https://img.qammunity.org/2020/formulas/mathematics/college/4ng1jk8lapbtdyzqso90osebtrs9eumqe1.png)

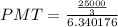

![PMT=((25000)/(3))/([1.006667^(300)-1])](https://img.qammunity.org/2020/formulas/mathematics/college/zjepdkraxf0svhi8ho9p90n8nkxgrleisv.png)

Monthly payment (PMT) = $1314.369409 ≈ $1314.37

$1314.37 is required monthly payment in order to $100,000 interest.