Answer:

Real return on investment: 22.9465%

Step-by-step explanation:

Okay let's explain each concept we have given:

Face Value $1,000

This is the ammount Lambert will pay at maturity

Purchase Value $ 960

This is the Ammount we pay for the bond

Market Value of the bond today $ ???

This is what we need to determinate to see the return we got

Once we got the market Value we will do:

Market Value / Purchase Value - 1 = rate of return

Now the market value today will be the present value of the bond, and the bond has the following data:

So each year we receive the 7% of the face value ($1,000) = $70

And at the end of the bond life we receive 1,000

We need to bring this numbers at present day using the real market rate, because the economy is having inflation:

market rate 8%

inflation rate 2.7%

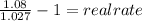

real rate:

(1+rate)/(1+inflation) -1 = real rate

real rate = 5.16%

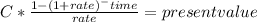

To know the present value of the bond we will have to consider:

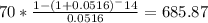

- present value of an annuity of 70$ during 14 year at a rate of 5.16% =

- present value of the 1,000 that will be pay at maturity at a rate of 5.16%

The annuity will be

$685,87

The present value of the 1,000 will be

face value/(1+rate)^time

1,000/(1+0.0516)^14 = $494,42

for a total of $1.180,29

Now we will calculate the real return on the investment:

we receive 1.180,29 for 960 so the rate is

1.180,29 /960 - 1 = 0.229465 = 22.9465%