Answer:

The depreciation expenses will be "950 and 3610". A further explanation is given below.

Step-by-step explanation:

The given values are:

Cost,

= $21,500

Salvage value,

= $2,500

Asset's total life,

= $100,000

Now,

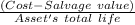

The Depreciation rate will be:

=

On putting the values, we get

=

=

=

So,

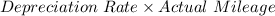

For the year 2021, the depreciation expense will be:

=

=

=

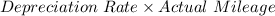

For the year 2022, the depreciation expense will be:

=

=

=