Answer:

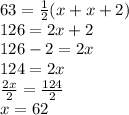

The value of x is 62

Explanation:

Given data is:

34,37,53,55,x,x+2,77,83,89and100

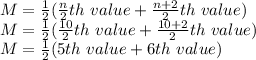

As the number of values is 10 (which is even number of values) i.e. n=10

The median will be the average of two middle values.

As it is already given that the median is 63

Putting M=63

Hence,

The value of x is 62