Answer: 0.0542438

Step-by-step explanation:

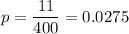

Given : The proportion of newly formed companies in 2010 appeared to have outstanding prospects :

The number of companies selected : n=2

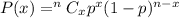

Using the binomial distribution, the probability of getting success in x trials :-

, where n is the total number of trials and p is the probability of getting success in each trial.

, where n is the total number of trials and p is the probability of getting success in each trial.

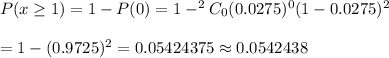

Then , the probability that at least one of the investor's companies had outstanding prospects :-

Hence, the probability that at least one of the investor's companies had outstanding prospects = 0.0542438