Answer:

The correct option is B.

Explanation:

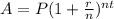

The formula for amount after compound interest is

Where P is principal, r is rate of interest, n is number of times interest compounded in a period, t is number of years.

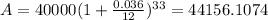

It is given that Felix took out an unsubsidized student loan of $40,000 at a 3.6% APR, compounded monthly. The amount after 33 month is

The amount after 33 month is $44156.1074. So, the new principle amount is $44156.1074.

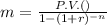

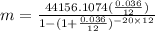

The monthly payment of $44156.1074 for 20 years is

Where, P.V. is present value, r is rate of interest and n is number of times interest compounded.

Therefore the correct option is B.