Answer:

The current per month mortgages are $1289.54 less than the earlier per month mortgages.

Explanation:

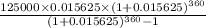

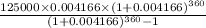

The EMI formula is =

Here p = 125000

For case 1:

r = 18.75/12/100=0.015625

n =

So, putting values in formula we get :

= $1960.51

For case 2:

r = 5/12/100=0.004166

n =

So, putting values in formula we get :

= $670.97

Now we will find the difference between both EMI's

dollars.

dollars.

Therefore, the current per month mortgages are $1289.54 less than the earlier per month mortgages.