Answer:

$3600

Explanation:

Given: Total Salary of Emily=40000

Total contribution of emily=$5000

To Find: Employer's contribution to the 401(k).

Solution:

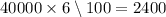

for the first

% of her salary:

% of her salary:

contribution made by Employer=

%

%

Total contribution left=

-

-

=

=

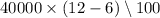

for the next

to

to

of her salary:

of her salary:

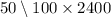

Emily's contribution=

contribution made by Employer=

%

%

Total contribution left=

For the rest of contribution Employer will not pay

So,

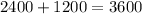

Total contribution made by emily's Employer in 401(k)=

Hence, The total contribution made by Employer is $3600