Answer:

Option A is correct answer.

Explanation:

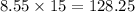

Per hour wage = $8.55

Number of hours in a week = 15

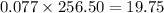

So, total pay of the week is =

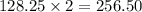

The biweekly salary becomes =

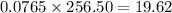

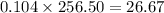

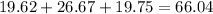

Deductions are as follows:

FICA (7.65%),

Federal tax withholding (10.4%),

State tax withholding (7.7%),

Now adding all the deductions we get:

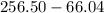

Subtracting the deductions from the biweekly pay we have =

= $190.46

= $190.46

Close to option A. Hence, option A is correct.