Answer:

Total Present value = $923.98

Total Future Value = $1,466.23

Explanation:

Given data:

total investment for next three year is $100

total investment for 4th year $200

total investment for 5th year $300

total investment for 6th year $500

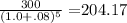

Present value is calculated as

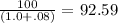

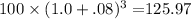

Year 1

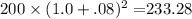

Year 2

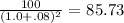

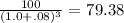

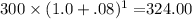

Year 3

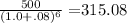

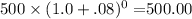

Year 4

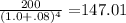

Year 5

Year 6

Total Present value = $923.98

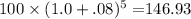

future value calculation:

Year 1

Year 2

Year 3

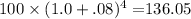

Year 4

Year 5

Year 6

Total Future Value = $1,466.23