Answer:

Explanation:

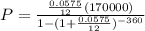

Since, the periodic payment of a loan,

Where, P.V. is the principal amount,

r is the rate per period,

n is the number of periods,

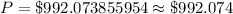

Given,

P.V. = $ 170,000,

Annual rate = 5.75 % = 0.0575,

Thus, the rate per month,

Also, time = 30 years,

So, the number of months in 30 years,

n = 360 ( 1 year =12 months )

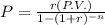

Hence, the monthly payment of the loan is,