Answer: C. June 15th

=====================================================

Step-by-step explanation:

Laura starts off with a balance of $606.40

This balance is in effect for x days, where x is some positive whole number between 1 and 30.

For the remaining 30-x days, her balance is 606.40-55.25 = 551.15 dollars after making the payment of $55.25

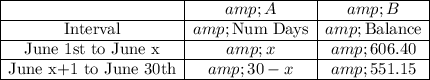

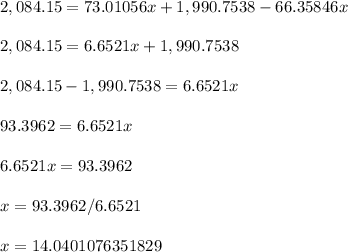

Here's a table to keep track of everything so far

where "Num Days" is shorthand for "number of days".

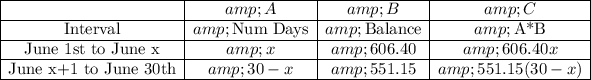

What we do is multiply the A and B column to form column C like this

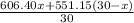

Add up the stuff in column C

606.40x+551.15(30-x)

Then divide by 30 to compute the average daily balance

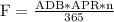

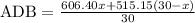

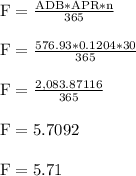

That average daily balance is plugged into this formula

where

- F = finance charge

- ADB = average daily balance

- APR = annual percentage rate

- n = number of days in the billing cycle

We are given the following

- F = 5.71

- APR = 0.1204

- n = 30

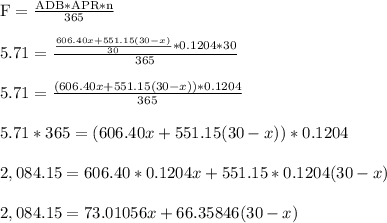

Plug in

and solve for x

and solve for x

So,

That value is approximate.

When rounding to the nearest whole number, we get x = 14.

Therefore, from June 1st to June 14th, Laura has a balance of $606.40

From June 15th to June 30th, she has a balance of $551.15

The payment was made on June 15th

--------------------------

Checking the answer:

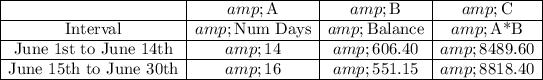

Here's the updated table with x replaced with 14. So x+1 = 14+1 = 15

Adding everything in column C gets us

8489.60+8818.40 = 17,308

Divide that over 30 days

(17,308)/30 = 576.93

Her average daily balance for the month of June is $576.93

Plug that into the formula mentioned to get the finance charge.

We get the correct finance charge of $5.71, so the answer has been confirmed.