Answer:

Exponential model best fits this situation.

Explanation:

Given : Karl has $400 in a savings account. The interest rate is 10%, compounded annually.

We have to determine which type of model best fits this situation.

Since, interest is calculated compounded

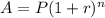

Using formula for compounded interest , we have,

Where P is principal amount

n is time period

r is interest rate

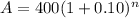

We are given P = $ 400

and r = 10 % = 0.10

Substitute, we have,

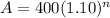

Now this is an equation of the form

which is exponential function.

which is exponential function.

So, exponential model best fits this situation.