Answer: He paid $ 4836 in taxes.

Explanation:

Here, the total value of the house = $ 93,000

And, the amount on which municipal taxes imposed = 80% of the value of house

= 80% of 93000

= 0.8 × 93000

= $ 74,400

Now, the tax rate is $65 per thousand,

⇒

,

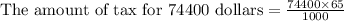

,

⇒

⇒

Thus, he paid $ 4836 in taxes.