Answer:

5.8%

Explanation:

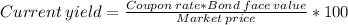

Current yield = 6.1%

Face value of bond = $500

Market price of bond = $475

Let the original coupon rate be CR

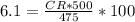

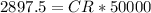

Multiply both sides by 475

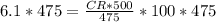

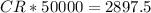

Cancel out the 475's from the top and bottom of the right side

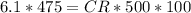

Flip the sides

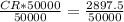

Divide both sides by 5000

Cancel out 50000 from the top and bottom of the left side

%

%

CR = 0.0579 * 100 [convert decimal into a percentage]

CR = 5.79 %

CR = 5.8% [rounded off to the tenth place]