Answer:

The answer is "156.25"

Explanation:

They recognize that international automobiles manufactured in the U.S. were typically commercial goods at the price fixed, either new used or, whether for personal use and sale: cars - 2.5%.

Through task, we learn that the overseas Fiat car which cost him 6250.

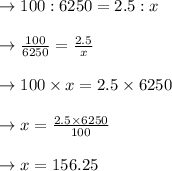

We get the proportion as follows:

The duty he has to pay is 156.25.