Answer:

The price of the stock will be $18.04

Step-by-step explanation:

The price of the stock will be the same as the present value of the future dividends including the liquidating final dividend of 20.00 discounted at 11%

present value of the dividends:

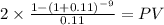

Present Value of Annuity

C 2

time 9

rate 0.11

PV $11.0741

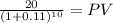

Then, PV of the liquidating dividend:

PRESENT VALUE OF LUMP SUM

Maturity 20.00

time 10.00

rate 0.11

PV 7.04

$11.07 + $7.04 = $ 18.04