Answer:

$143137.25

Step-by-step explanation:

Given that:

The annual gross income = $54000

The monthly gross income = $54000/12

= $4500

Using the PITI guideline, a mandatory expense of 38% of monthly income is applied.

So;

Expense = $4500 × 38% = $1710

Additional Monthly debt = $810

Cost of Prop. Taxes and H.O insurance = $170

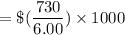

Monthly Balance left = $1710 - $(810 + 170) = $730

Mortgage payment factor = 6.00

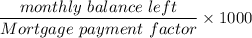

Monthly mortgage payment =

= $121666.67

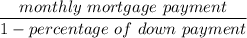

Affordable home purchase price =

= $143137.25