Answer:

The right approach is "55800".

Step-by-step explanation:

The given values is:

Rate of interest,

= 9%

= 0.09

The interest cost will be:

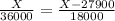

=

=

($)

($)

Assumed return on capital employed are X. Break will also be whenever the dual capital requirements participate in almost the same earnings growth.

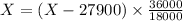

⇒

⇒

⇒

⇒

⇒