Given :

Bud exchanges land with an adjusted basis of $ 22,000 and a fair market value of $ 30,000 for another parcel of land with a fair market value of $ 28,000 and $2,000 cash.

To Find :

What is Bud's recognized gain or loss.

Solution :

This is a transaction of like kind exchange.

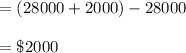

So, gain or loss to be recognized is :

Therefore, option B) is correct.