Explanation:

i = interest 3% for 30 years

This is a simple dynamical system for whom the the solutions are given as

](https://img.qammunity.org/2021/formulas/mathematics/college/8c5bwmd57h2of17yhscwec323olrvs598c.png)

putting values we get

S=2000[\frac{(1.03)^{30}-1}{0.03}](1.03)

= $98005.35

withdrawal of money takes place from one year after last payment

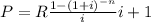

To determine the result we use the present value formula of an annuity date

we need to calculate R so putting the values and solving for R we get

R= $6542.2356