Answer: down below...

Explanation:

Exercise 1:

Income = $83.465

Tax paid at 5.05% means, whatever your income is, you gotta pay 5.05% of it as a tax.

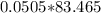

5.05% =

If you do the calculations it should give you a $4,214.9825 tax

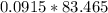

"Income tax paid at 9.15%"

The 9.15% tax = $7,637.0475

"Total income tax paid"

This will just be the sum of the two taxes.

$4,214.9825+$7,637.0475 = $11,852.03 (sum of taxes)

Exercise 2:

Purchase price = $347.000

Selling price = $863.000

As you can see, they purchased the property for $347.000 and sold it for $863.000 which made them a lot of money in profit :)

That's what the Difference is.

Difference = $863.000-$347.000

Difference = $516,000

I don't really understand what capital gains are, because I'm 13, but I suppose I gotta calculate 50% of the profit that the banker has made.

"Capital gains" = $258,000

I don't really know if this is the correct answer for capital gains, but I am pretty sure I did well on the other ones.

Hope I helped you :] !