Answer:

b. $22,276.71

Step-by-step explanation:

From the given information:

using the basic time value of money function for PV of an annuity:

![PV = P \Bigg [ (1-(1+r)^(-n))/(r) \Bigg ]](https://img.qammunity.org/2021/formulas/business/college/m1r73y8o8xb4zwfs4dnpbc3h1lsq6mnll9.png)

where;

P = annual Periodic Payment

r = rate per period = 15%

n = number of periods = 25

Present value PV = 144000

![144000= P \Bigg [ (1-(1+0.15)^(-25))/(0.15) \Bigg ]](https://img.qammunity.org/2021/formulas/business/college/eoqaj5h77kh50urak5h6wg5yf6o5jqhgsd.png)

![144000= P \Bigg [ (1-(1.15)^(-25))/(0.15) \Bigg ]](https://img.qammunity.org/2021/formulas/business/college/l9tea3ldl0ky03pymvdwskoypedgs1x4vp.png)

![144000= P \Bigg [ (1-0.0303776)/(0.15) \Bigg ]](https://img.qammunity.org/2021/formulas/business/college/yc0qmampr4a1xf2sahm964ey7dxp2vfu3x.png)

![144000= P \Bigg [ (0.9696224)/(0.15) \Bigg ]](https://img.qammunity.org/2021/formulas/business/college/g0xy2kszcvc2mdcxjs9bz1co5pn6qy440p.png)

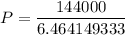

![144000= P \Bigg [6.464149333 \Bigg ]](https://img.qammunity.org/2021/formulas/business/college/3tfp5szvclycd1zz39vhv4jqioxm5zkzc4.png)

P = $22276.71